LINE OF CREDIT

A line of credit gives you continuous access to working

capital for your business so you have it when you need it most

A line of credit gives you continuous access to working capital for your business so you have it when you need it most.

Application Process

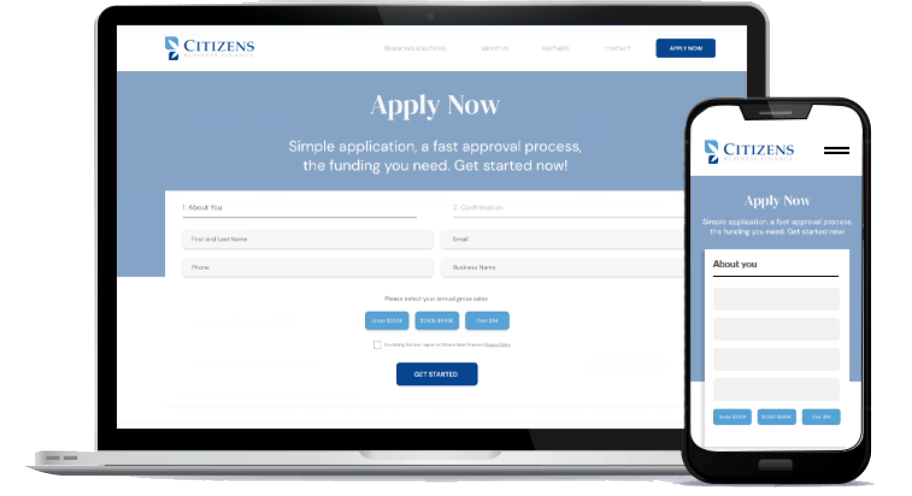

You can apply online or with a dedicated funding specialist. We recommend having the necessary documents on hand to make the process even faster (i.e. driver’s license or passport for the business owner, copies of business bank statements).

A dedicated funding specialist will carefully review your business financing application and reach out if we need any additional information. Once a funding decision has been made your dedicated funding specialist will reach out to you with funding options if approved.

If approved and you accept an offer funds will be sent to the business bank account provided. You could have your loan funds in as quick as 24 hours.

Find out how much you qualify for

"*" indicates required fields

Line of Credit FAQs

A line of credit is a flexible loan from a financial institution that consists of a defined amount of money that you can access as needed. You can repay what you borrow from a line of credit immediately or over time in regular minimum payments. Interest is charged on a line of credit as soon as money is borrowed.

Applying for a business line of credit with Citizens Business Finance is simple and easy. You can apply online or with a dedicated funding specialist. We recommend having the necessary documents on hand to make the process even faster (i.e. driver’s license or passport for the business owner, copies of business bank statements). A dedicated funding specialist will carefully review your business line of credit application and reach out if we need any additional information. Once a funding decision has been made your dedicated funding specialist will reach out to you with the line of credit options if approved. If approved you could access your line of credit in as quick as 24 hours.