BUSINESS CASH ADVANCE

Get fast access to working capital

with a Business Cash Advance

A Business Cash Advance is not a loan and therefore does not come with a fixed term or an APR. Instead, with a business cash advance, a party purchases the future receivables of a business at discount. As you make those sales or your accounts receivable pay during your normal course of business, you pay a percentage of your revenue to the party that purchased your receivables.

A Business Cash Advance is not a loan and therefore does not come with a fixed term or an APR. Instead, with a business cash advance, a party purchases the future receivables of a business at discount. As you make those sales or your accounts receivable pay during your normal course of business, you pay a percentage of your revenue to the party that purchased your receivables.

There are a few major differences between a business cash advance and a loan.

Application Process

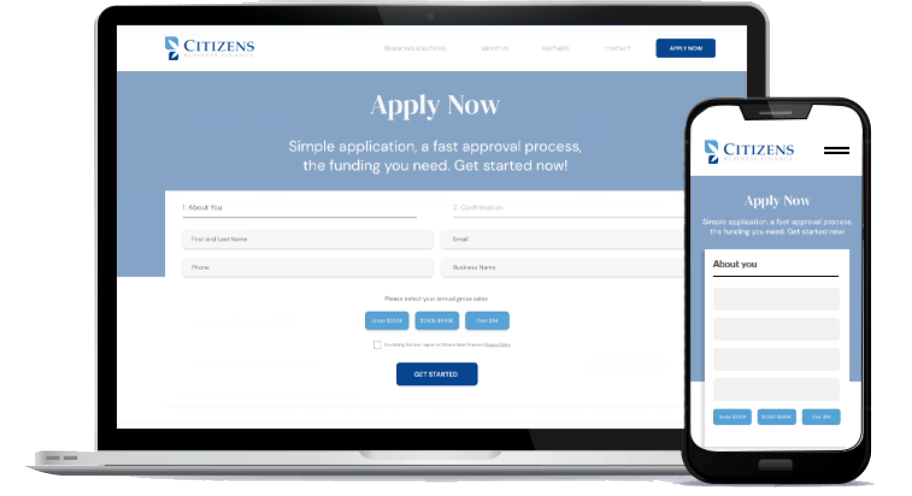

Apply online or with a dedicated funding specialist

You can apply online or with a dedicated funding specialist. We recommend having the necessary documents on hand to make the process even faster (i.e. driver’s license or passport for the business owner, copies of business bank statements).

Review by dedicated funding specialist

A dedicated funding specialist will carefully review your business financing application and reach out if we need any additional information. Once a funding decision has been made your dedicated funding specialist will reach out to you with funding options if approved.

Get Funded

If approved and you accept an offer funds will be sent to the business bank account provided. You could have your loan funds in as quick as 24 hours.

Application Process

You can apply online or with a dedicated funding specialist. We recommend having the necessary documents on hand to make the process even faster (i.e. driver’s license or passport for the business owner, copies of business bank statements).

A dedicated funding specialist will carefully review your business financing application and reach out if we need any additional information. Once a funding decision has been made your dedicated funding specialist will reach out to you with funding options if approved.

If approved and you accept an offer funds will be sent to the business bank account provided. You could have your loan funds in as quick as 24 hours.

Find out how much you qualify for

"*" indicates required fields

Business Cash Advance FAQs

A Business Cash Advance works by giving a business access to working capital in return for a portion of their future credit card or other receivables at a discounted price.

A small business that wants to apply for a Business Cash Advance must have accounts receivable such as credit/debit card sales and future accounts receivable. Applying for a Business Cash Advance is fast and easy! It should only take about 10-15 minutes to complete the application and provide the required documents. To get started, simply fill out our online application and a funding specialist will reach out to you for your three most recent business bank statements…and you’re all set! Once your package has been submitted your dedicated funding specialist will be in touch with a funding decision in as quick as 24 hours.

We know your credit score doesn’t tell the whole story of your small business. That’s why we consider other qualifying factors, such as time in business and average monthly revenue. Even if your credit is less than stellar, we’ll work with you to find the lending option that makes the most sense for your business.

A Business Cash Advance is a purchase and sales transaction where a financing company purchases a portion of a business’s future revenue stream at a discount in exchange for an upfront sum of working capital.

A small business loan is when a financing company lends money to a borrower and the borrower must repay the small business loan with fixed payments.