EQUIPMENT LEASING

No-hassle financing for the equipment you need,

from the seller of your choice

No-hassle financing for the equipment you need , from the seller of your choice

Application Process

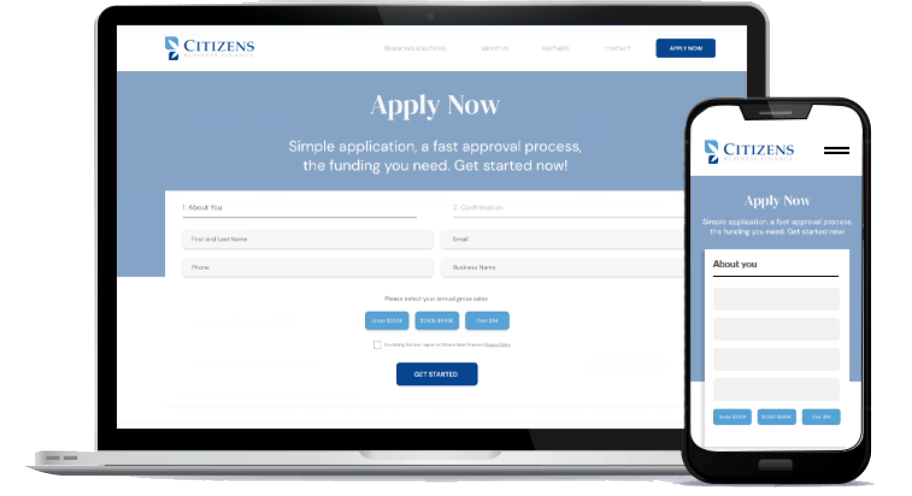

You can apply online or with a dedicated funding specialist. We recommend having the necessary documents on hand to make the process even faster (i.e. driver’s license or passport for the business owner, copies of business bank statements).

A dedicated funding specialist will carefully review your business financing application and reach out if we need any additional information. Once a funding decision has been made your dedicated funding specialist will reach out to you with funding options if approved.

If approved and you accept an offer funds will be sent to the business bank account provided. You could have your loan funds in as quick as 24 hours.

Find out how much you qualify for

"*" indicates required fields

Equipment Leasing FAQs

Equipment financing is the process of obtaining business equipment using a loan or lease. Equipment financing loans allow you to purchase the equipment with payments made over time. Equipment leasing, on the other hand, gets you the equipment you need without the intention of owning it. You’ll make a regular lease payment to continue using the equipment as if it were your own. When the lease is up, you can give the equipment back or renew the lease. Sometimes you may have options for purchasing the equipment at the end of the lease.

Equipment financing works by providing you with the equipment your business needs for a periodic payment which includes interest. After the set term of months for your loan or lease is over, you’ll either own your equipment outright or will need to make a decision about your lease. Generally, you can renew your lease if the equipment is in good condition and still helpful to your business. You can finance almost any type of major equipment your business needs to run smoothly, expand and maintain competitiveness.

You may be able to finance equipment for a short period of time or even as long as a decade plus. The specific length of your equipment financing term depends on several factors. If you’re purchasing expensive equipment with a loan, you may need to make payments for several years. On the other hand, if you’re leasing equipment with a fast depreciation, you may only want to lease it for a couple of years.

We know your credit score doesn’t tell the whole story of your small business. That’s why we consider other qualifying factors, such as time in business and average monthly revenue. Even if your credit is less than stellar, we’ll work with you to find the financing / lease option that makes the most sense for your business to get the equipment it needs.