SBA LOAN

With longer repayment terms and lower rates,

SBA-backed loans are an excellent choice when

you need funding to grow your small business

With longer repayment terms and lower rates , SBA-backed loans are an excellent choice when you need funding to grow your small business.

We understand the SBA process so you don’t have to. After you start your application, we’ll walk you through every step and answer your questions along the way. But if you’d like to do a little research before you begin, you can learn more here.

SBA eligibility requirements

Many small businesses from a broad range of industries can successfully apply for an SBA 7(a) loan. Rather than listing what businesses are considered for approval, the Small Business Administration lists those industries that are excluded.

- Gambling

- Life insurance

- Religious teaching

- Primarily political and lobbying activities

- Oil wildcatting

- Mining

- Mortgage servicing

- Real estate development

- Bail bond

- Pawn or private clubs

- Time in business must be above two years

- The business owner’s personal credit score must be above 650

- Business must be U.S. based and owned by a U.S. citizen or lawful permanent resident who is at least 21-years old

- No outstanding tax liens

- No bankruptcies or foreclosures in the past 3 years

- No recent charge-offs or settlements

- Up-to-date on government-related loans

Typically, businesses approved for an SBA loan from banks we work with have $120,000 to $5 million in annual revenues and 1 to 40 employees. Most are profitable and have a positive cash flow. All can provide proof that they are able to make the monthly loan payment.

SBA 7(a) Loan – Use of proceeds

With longer repayment terms and lower rates,

SBA-backed loans are an excellent choice when

you need funding to grow your small business

With longer repayment terms and lower rates , SBA-backed loans are an excellent choice when you need funding to grow your small business.

We understand the SBA process so you don’t have to. After you start your application, we’ll walk you through every step and answer your questions along the way. But if you’d like to do a little research before you begin, you can learn more here.

Many small businesses from a broad range of industries can successfully apply for an SBA 7(a) loan. Rather than listing what businesses are considered for approval, the Small Business Administration lists those industries that are excluded.

- Gambling

- Life insurance

- Religious teaching

- Primarily political and lobbying activities

- Oil wildcatting

- Mining

- Mortgage servicing

- Real estate development

- Bail bond

- Pawn or private clubs

- Time in business must be above two years

- The business owner’s personal credit score must be above 650

- Business must be U.S. based and owned by a U.S. citizen or lawful permanent resident who is at least 21-years old

- No outstanding tax liens

- No bankruptcies or foreclosures in the past 3 years

- No recent charge-offs or settlements

- Up-to-date on government-related loans

Typically, businesses approved for an SBA loan from banks we work with have $120,000 to $5 million in annual revenues and 1 to 40 employees. Most are profitable and have a positive cash flow. All can provide proof that they are able to make the monthly loan payment.

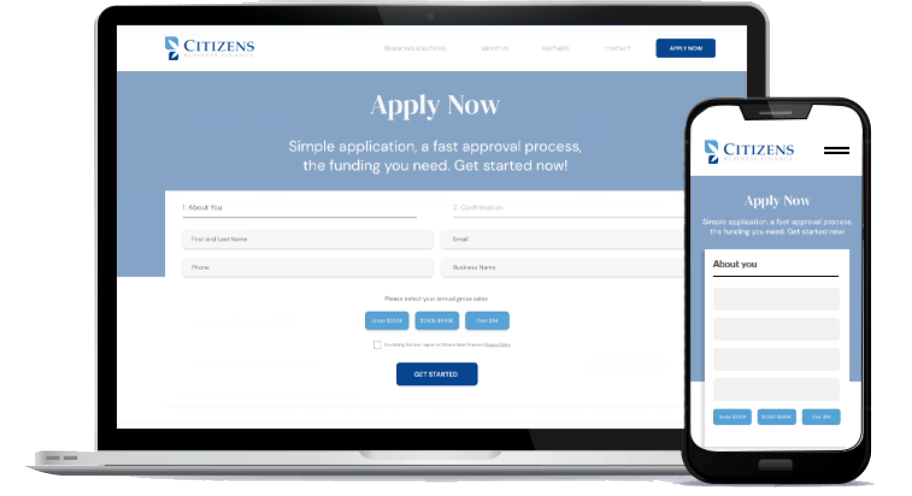

Application Process

You can apply online or with a dedicated funding specialist. We recommend having the necessary documents on hand to make the process even faster (i.e. driver’s license or passport for the business owner, copies of business bank statements).

A dedicated funding specialist will carefully review your business financing application and reach out if we need any additional information. Once a funding decision has been made your dedicated funding specialist will reach out to you with funding options if approved.

If approved and you accept an offer funds will be sent to the business bank account provided. You could have your loan funds in as quick as 24 hours.

Find out how much you qualify for

"*" indicates required fields

SBA Loan FAQs

An SBA loan is a government-guaranteed small business loan that has a long-term and a low-interest rate. The Small Business Administration (SBA) is the government agency that partially guarantees SBA loans and was founded in 1953 to support small business owners across the United States.

The most common misunderstanding about these loans is that the agency lends money directly to small businesses. However, the agency typically does not make direct loans. The SBA provides a guarantee on the loan, promising to reimburse the bank for a certain percentage of your loan if you default on that loan. This guarantee lowers the risks to banks and other lenders, encouraging them to offer these loans to more American small businesses. Many banks and other financial institutions offer SBA loans, but their process, requirements, and fees can vary.

You must be 2+ years in business with good credit and cash flow to qualify. The minimum Fico score for a SBA Loan is generally 650

If you are not approved for a SBA loan we also offer non-SBA business loans, business cash advances, asset backed loans, line of credit & equipment leasing.